Celebrity News | Interesting updates about the latest celebrity news

Central Bank Interest Rates: Understanding The Role And Impact On Economy

"Central Bank Interest Rates: Understanding The Role And Impact On Economy", a question that every individual should be aware of as it affects the economy and financial stability.

Editor's Notes: "Central Bank Interest Rates: Understanding The Role And Impact On Economy" have published today 3rd August 2023. As we're entering 2023 and interest rates have started to rise in many countries, we believe that readers will benefit from a clear and accessible guide to the role of interest rates in the economy. This article will help you to understand how interest rates affect everything from economic growth to inflation, why central banks set interest rates, and the impact of interest rates on businesses, consumers, and the economy as a whole.

Nothing can be more rewarding than making the right decisions, keeping that in mind we did some analysis, digging information, made some brainstorming, and put together this "Central Bank Interest Rates: Understanding The Role And Impact On Economy" to help our target audience make the right decision.

FAQ

Central bank interest rates are a key financial tool used to regulate the economy and control inflation. They can impact businesses, consumers, and the overall economic outlook. Here are some frequently asked questions to help you understand their role and impact.

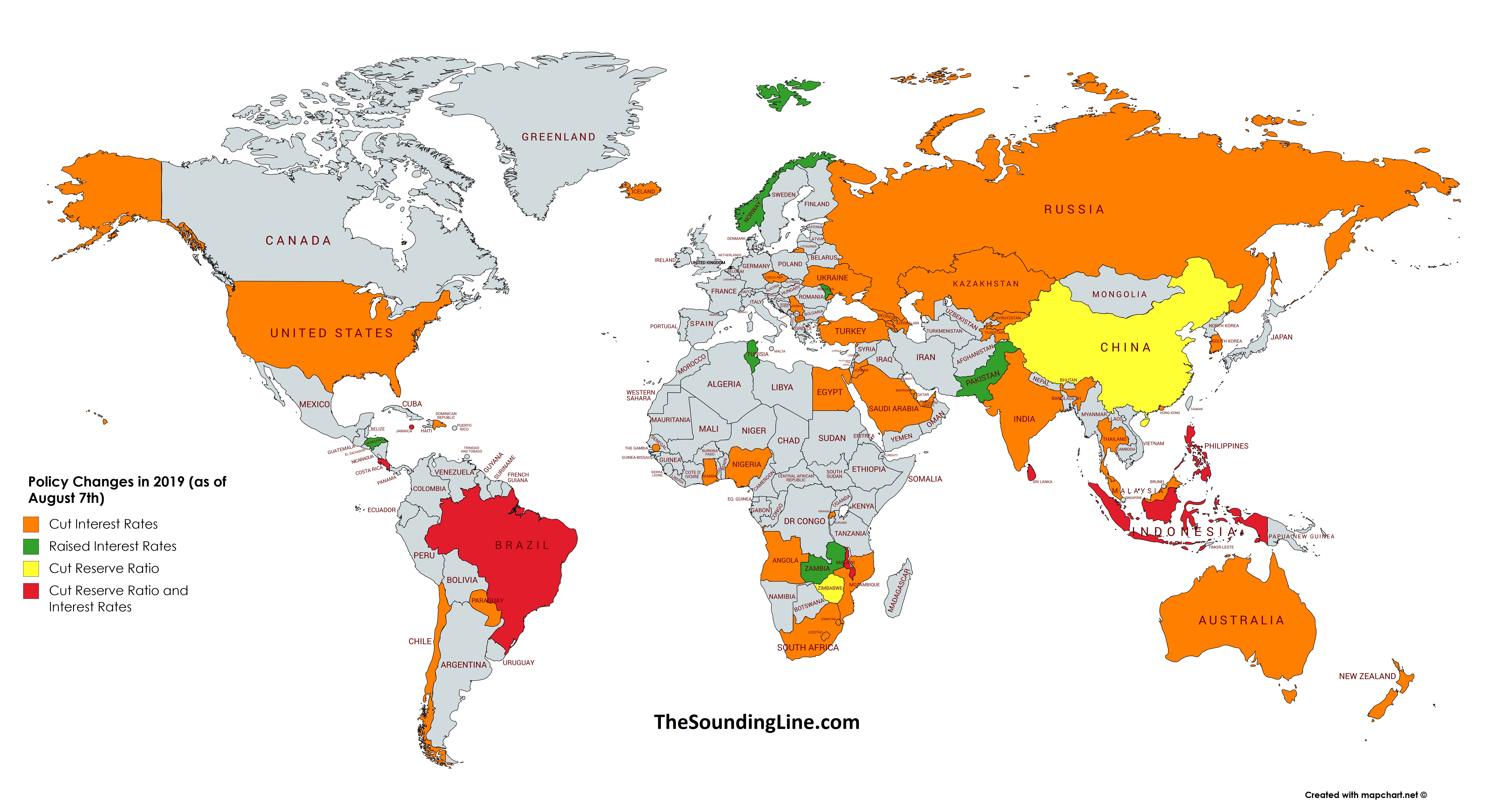

Map: The Global Easing Cycle Has Started - The Sounding Line - Source thesoundingline.com

Question 1: What are central bank interest rates?

Central bank interest rates are the interest rates at which a central bank lends money to commercial banks and other financial institutions. By adjusting these rates, the central bank can influence the cost of borrowing and lending, thus affecting economic activities.

Question 2: How do interest rates affect the economy?

Higher interest rates make borrowing more expensive and reduce consumer spending and investment, slowing economic growth. Conversely, lower interest rates encourage borrowing and spending, stimulating economic activity.

Question 3: What is the relationship between interest rates and inflation?

Central banks typically raise interest rates to combat inflation and lower them to promote economic growth. Raising interest rates discourages spending and slows economic growth, ultimately reducing demand-driven price increases.

Question 4: How do interest rates affect businesses?

Higher interest rates can increase business costs, especially for those that rely heavily on borrowing. They may also discourage investment and expansion plans. Conversely, lower interest rates can support business growth and investment.

Question 5: How do interest rates affect consumers?

Higher interest rates can increase mortgage and consumer loan payments, reducing disposable income. They may also affect savings accounts and other interest-bearing investments. Lower interest rates can have the opposite effects, making it easier for consumers to borrow and save.

Question 6: What are the potential risks of adjusting interest rates?

Adjusting interest rates can have unintended consequences, such as overly slowing economic growth or exacerbating inflation. Therefore, central banks carefully consider the potential risks and benefits before making any changes.

In conclusion, central bank interest rates play a crucial role in managing the economy, inflation, and financial stability. By understanding their purpose and effects, you can better navigate economic fluctuations and make informed financial decisions.

Moving forward, we will explore other aspects of central banking and its impact on the economy.

Tips

Central bank interest rates are a powerful tool that can impact the economy in a number of ways. By understanding how interest rates work, businesses and consumers can make better decisions about their spending and investment.

Tip 1: Understand the role of interest rates

Interest rates are the price of borrowing money. When interest rates are high, it is more expensive to borrow money, which can slow down economic growth. When interest rates are low, it is cheaper to borrow money, which can stimulate economic growth.

Tip 2: Monitor interest rate trends

Interest rates are constantly changing, so it is important to monitor trends to see how they are likely to affect the economy. Central Bank Interest Rates: Understanding The Role And Impact On Economy If interest rates are rising, it is likely that the economy is slowing down. If interest rates are falling, it is likely that the economy is growing.

European Central Bank Raises Interest Rates Again, but Only a Quarter - Source www.nytimes.com

Tip 3: Consider the impact of interest rates on your finances

Interest rates can have a significant impact on your finances. If interest rates are rising, it is likely that your mortgage or car payment will increase. If interest rates are falling, it is likely that your savings account will earn less interest.

Tip 4: Make informed decisions about your spending and investment

By understanding how interest rates work, you can make informed decisions about your spending and investment. If interest rates are rising, it may be a good time to save money and pay down debt. If interest rates are falling, it may be a good time to invest in stocks or bonds.

Summary

Interest rates are a powerful tool that can impact the economy and your finances in a number of ways. By understanding how interest rates work, you can make better decisions about your spending and investment.

Central Bank Interest Rates: Understanding The Role And Impact On Economy

Central bank interest rates play a crucial role in shaping an economy's financial landscape and overall performance. By adjusting these rates, central banks influence various aspects of economic activity, from inflation to investment.

- Monetary Policy Tool: A central bank's primary tool for influencing economic conditions.

- Inflation Control: Higher interest rates curb inflation, while lower rates stimulate growth.

- Economic Growth: Low interest rates encourage borrowing and spending, fostering growth.

- Exchange Rates: Interest rate differentials affect currency values, impacting trade and investment.

- Financial Stability: High interest rates can mitigate financial imbalances, but also slow growth.

- Market Confidence: Central bank credibility and clear communication enhance market confidence.

Central bank interest rates are a powerful instrument, carefully calibrated to balance inflation, growth, and financial stability. By influencing these rates, central banks seek to create a stable and prosperous economic environment. For example, during economic downturns, lower interest rates stimulate growth, while higher rates may be necessary to curb inflation during periods of strong economic growth.

Central Bank Interest Rates: Understanding The Role And Impact On Economy

Central bank interest rates are a critical tool used by monetary authorities to influence economic activity. By setting the interest rate at which banks lend to each other, central banks can impact the cost of borrowing and spending in the wider economy. In this way, central bank interest rates play a significant role in economic growth, inflation, and financial stability.

European Central Bank raises interest rates again in battle against - Source businessnow.mt

One of the primary goals of central bank interest rate policy is to manage economic growth. When the economy is growing too slowly, central banks can lower interest rates to make it less expensive for businesses to invest and for consumers to borrow. This can stimulate economic activity and lead to higher growth rates. Conversely, when the economy is growing too quickly, central banks can raise interest rates to slow down borrowing and spending and help prevent inflation.

Another key role of central bank interest rates is to manage inflation. Inflation is the rate at which prices for goods and services rise over time. If inflation is too high, it can erode the purchasing power of consumers and make it more difficult for businesses to plan and invest. Central banks can use interest rates to control inflation by making borrowing and spending less attractive, thereby reducing demand for products and services and slowing down price increases.

In addition to managing growth and inflation, central bank interest rates also play a role in financial stability. By setting interest rates, central banks can influence the level of risk in the financial system. For example, raising interest rates can make it more expensive for banks to borrow and lend, which can help to reduce the risk of excessive lending and financial bubbles.

Overall, central bank interest rates are a powerful tool that can be used to influence economic activity, control inflation, and manage financial stability. Understanding the role and impact of central bank interest rates is essential for understanding how the economy works and how governments and policymakers make decisions that affect our everyday lives.

Conclusion

Central bank interest rates are a critical tool for managing economic growth, inflation, and financial stability. By setting the interest rate at which banks lend to each other, central banks can influence the cost of borrowing and spending in the wider economy, thereby impacting economic activity, price levels, and risk.

Understanding the role and impact of central bank interest rates is essential for understanding how the economy works and how governments and policymakers make decisions that affect our everyday lives. As the global economy continues to evolve, central bank interest rates will likely remain a key policy tool for managing economic conditions and achieving economic goals.