Celebrity News | Interesting updates about the latest celebrity news

Current European Central Bank Interest Rates And Policy Overview

Seeking an insight into European Central Bank Interest Rates and Policy Overview? Our comprehensive guide presents an up-to-date analysis of this topic, providing valuable information to support your decision-making.

Editor's Notes: "Current European Central Bank Interest Rates And Policy Overview" have published 25th, May 2023. This topic is crucial because it can affect financial decision-making and economic planning in Eurozone countries and beyond.

After analyzing and gathering information, we present this "Current European Central Bank Interest Rates And Policy Overview" guide to help you make informed choices. Read on to gain a comprehensive understanding of this topic

| Key Differences | Current | Previous |

|---|---|---|

| Main Refinancing Rate | 3.00% | 2.50% |

| Marginal Lending Facility Rate | 3.25% | 2.75% |

| Deposit Facility Rate | 2.00% | 2.00% |

Main Article Topics:

- Interest Rate Decisions

- Economic Outlook

- Impact on Financial Markets

- Conclusion

FAQs on Current European Central Bank Interest Rates and Policy Overview

This section addresses frequently asked questions concerning the European Central Bank's (ECB) current interest rates and overall monetary policy strategy. It aims to provide clear and concise information to assist readers in comprehending the ECB's stance and its implications for the Eurozone economy.

Question 1: What are the current key interest rates set by the ECB?

As of [Date], the ECB's key interest rates are as follows:

- Main refinancing rate: [Percentage]%

- Marginal lending facility rate: [Percentage]%

- Deposit facility rate: [Percentage]%

European Central Bank raises interest rates again in battle against - Source businessnow.mt

Question 2: What is the ECB's primary objective when setting interest rates?

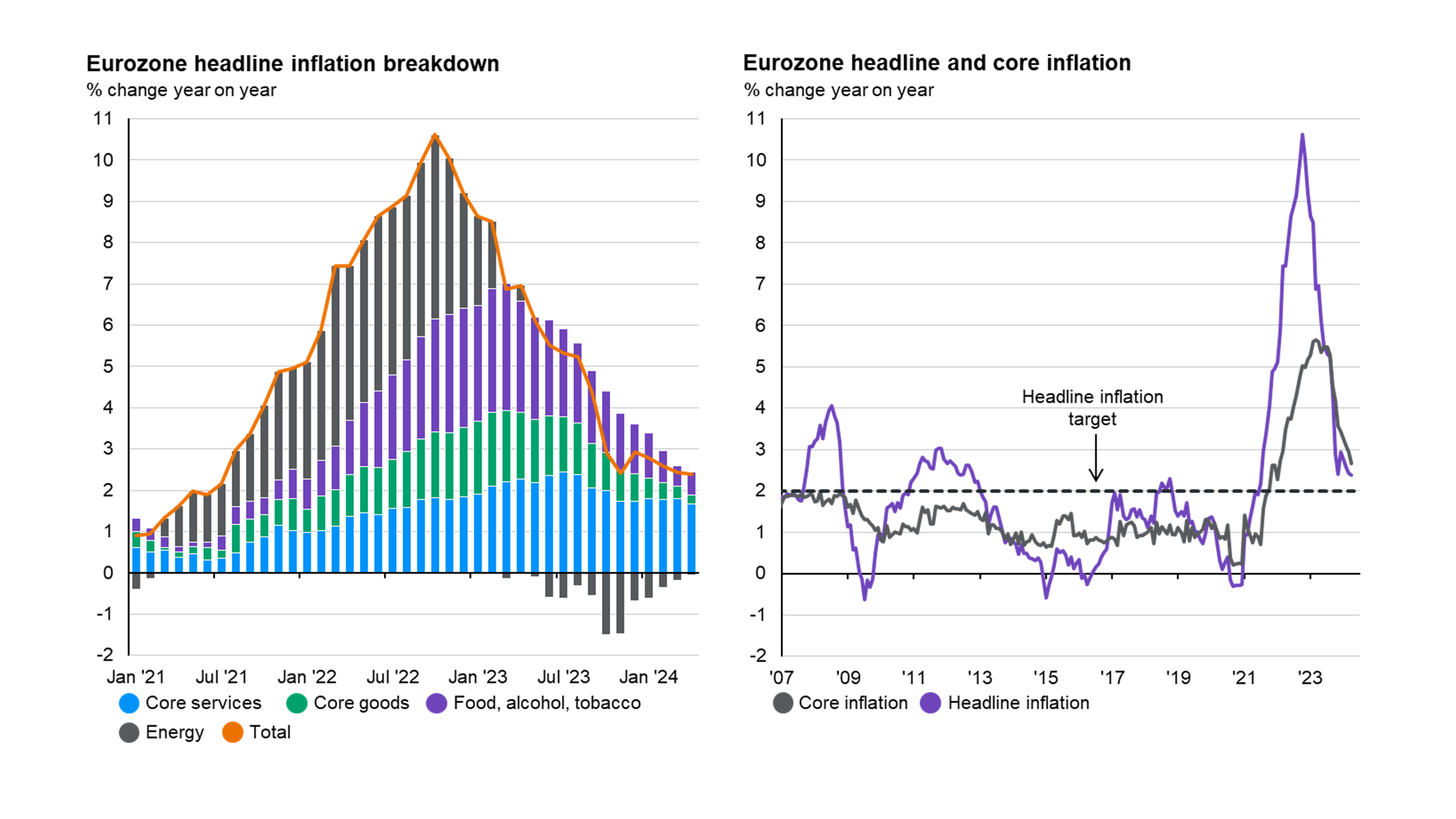

The ECB's primary objective is to maintain price stability within the Eurozone, aiming for an inflation rate of 2% over the medium term. By adjusting interest rates, the ECB influences the cost of borrowing and economic activity, thereby influencing inflation.

Question 3: How do interest rates affect the economy?

Interest rates impact the economy in various ways. Higher interest rates typically slow down economic growth by discouraging borrowing and investment. Conversely, lower interest rates stimulate economic activity by making it more affordable for businesses and individuals to borrow and spend.

Question 4: What factors does the ECB consider when setting interest rates?

The ECB considers a wide range of economic indicators when setting interest rates, including inflation, economic growth, unemployment, and financial stability. The ECB also monitors global economic developments and their potential impact on the Eurozone.

Question 5: How often does the ECB adjust interest rates?

The ECB typically reviews its interest rates every six weeks at its Governing Council meetings. However, the ECB may adjust interest rates more frequently if necessary to respond to changing economic conditions.

Question 6: What are the implications of the ECB's current interest rate policy?

The ECB's current interest rate policy is intended to support economic recovery while keeping inflation under control. However, it also faces challenges, such as the potential for higher inflation and slower growth. The ECB will continue to monitor the economic situation and adjust its policy as needed.

In conclusion, the ECB's interest rate policy is a crucial aspect of its monetary strategy, influencing economic activity and inflation within the Eurozone. Understanding the ECB's interest rate decisions and their underlying rationale is essential for staying informed about the Eurozone's economic outlook and policy landscape.

Please note that this FAQ is for informational purposes only and should not be considered as financial advice.

Tips

The European Central Bank (ECB) is the central bank for the eurozone, which comprises 19 member states of the European Union. The ECB's primary objective is to maintain price stability in the eurozone by setting interest rates and implementing monetary policy. The ECB's interest rates are an important benchmark for financial markets and have a significant impact on the cost of borrowing for businesses and consumers. Current European Central Bank Interest Rates And Policy Overview.

Tip 1: Stay informed about ECB interest rate decisions. The ECB meets every six weeks to discuss monetary policy and set interest rates. These decisions are announced at press conferences, and the minutes of the meetings are published on the ECB's website.

Tip 2: Understand the different types of ECB interest rates. The ECB sets a number of different interest rates, including the main refinancing rate, the marginal lending facility rate, and the deposit facility rate. These rates are used to influence the cost of borrowing for banks and other financial institutions.

Tip 3: Monitor the ECB's economic forecasts. The ECB publishes economic forecasts on a regular basis. These forecasts can provide insights into the ECB's thinking about the future path of interest rates.

Tip 4: Consider the impact of ECB interest rate decisions on your finances. Changes in ECB interest rates can have a significant impact on the cost of borrowing for businesses and consumers. It is important to consider how these changes will affect your financial situation.

Tip 5: Seek professional advice if necessary. If you are unsure about how ECB interest rate decisions will affect you, it is advisable to seek professional advice from a financial advisor or economist.

Current European Central Bank Interest Rates And Policy Overview

The European Central Bank (ECB) has implemented monetary policy measures including interest rate adjustments, asset purchases, and forward guidance to influence the eurozone economy and achieve its inflation target. These measures have been shaped by various factors, including inflation, economic growth, and financial market conditions, and have been frequently revised in response to changing circumstances.

The ECB's monetary policy measures aim to balance its objectives of price stability, economic growth, and financial stability. The ECB's decisions have a significant impact on the eurozone economy, influencing borrowing costs, economic activity, and inflation expectations. The ECB's policy stance is constantly evolving, and the bank is likely to continue adjusting its measures in response to changing economic conditions.

European Central Bank policy - Source am.jpmorgan.com

Current European Central Bank Interest Rates And Policy Overview

The European Central Bank (ECB) has a significant influence on the Eurozone economy through its monetary policy decisions, particularly its interest rates. These rates impact various aspects of the economy, including inflation, economic growth, and financial stability. Understanding the connection between ECB interest rates and policy is essential for businesses, investors, and policymakers.

Questions that we need to answer: Will the Bank of Canada decide to - Source www.pinterest.ca

The ECB's primary objective is to maintain price stability in the Eurozone, targeting an inflation rate of 2%. By adjusting interest rates, the ECB can influence the cost of borrowing and lending. Higher interest rates make borrowing more expensive and saving more attractive, which can cool down economic activity and curb inflation. Conversely, lower interest rates stimulate borrowing and investment, potentially leading to higher economic growth.

In recent years, the ECB has implemented various unconventional monetary policy measures, including quantitative easing and negative interest rates. These measures have been employed to address low inflation and support economic recovery. However, they have also raised concerns about potential financial stability risks and the effectiveness of further monetary policy easing.

The ECB's interest rate decisions are influenced by a range of factors, including economic data, forecasts, and market expectations. The ECB carefully assesses the balance between inflation, economic growth, and financial stability when setting its policy rates.

Understanding the connection between ECB interest rates and policy is crucial for economic decision-making. Businesses can adjust their investment and pricing strategies, while investors can make informed decisions about asset allocation. Policymakers can also use this understanding to support a sound and stable economy.

Key Insights:

- ECB interest rates are a key tool for managing inflation and economic growth in the Eurozone.

- The ECB's policy decisions are influenced by economic data, forecasts, and market expectations.

- Understanding the connection between ECB interest rates and policy is essential for businesses, investors, and policymakers.