Celebrity News | Interesting updates about the latest celebrity news

MSCI World Index: A Comprehensive Guide To Global Equity Market Performance

MSCI World Index: A Comprehensive Guide To Global Equity Market Performance is a valuable source that provides deep analysis about the global equity market performance for investors, fund managers, and all market participants.

Editor's Notes: "MSCI World Index: A Comprehensive Guide To Global Equity Market Performance" is published today as it is a pressing topic on the market that investors should be aware of.

Our team has devoted countless hours to researching, analyzing, and compiling data to bring you this comprehensive guide on the MSCI World Index. We understand the importance of staying informed about global equity market performance, and we believe this guide will provide you with the insights you need to make sound investment decisions.

Key Takeaways:

| Key Differences | MSCI World Index | Other Global Equity Indices |

|---|---|---|

| Number of Constituents | ~1,600 stocks | Varies, typically smaller |

| Market Coverage | Developed markets only | Developed and emerging markets |

| Weighting Scheme | Market capitalization-weighted | May use different weighting schemes |

| Dividend Reinvestment | Yes | May or may not |

| Currency | USD | May be available in multiple currencies |

Main Article Topics:

FAQs

This comprehensive guide addresses frequently asked questions regarding the MSCI World Index, a benchmark for global equity market performance.

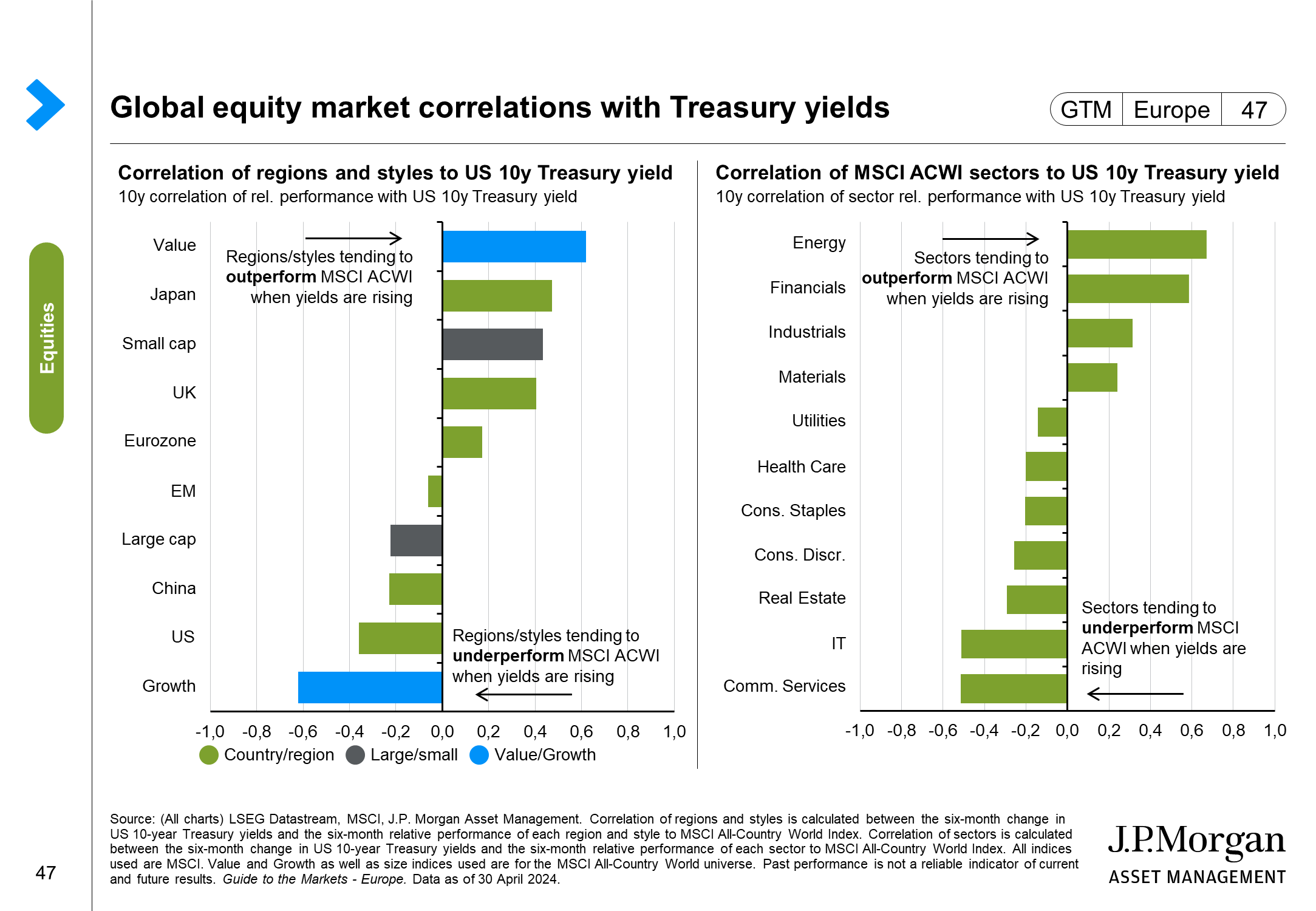

Global equity market correlations with Treasury yields - Source am.jpmorgan.com

Question 1: What is the MSCI World Index?

The MSCI World Index is a market capitalization-weighted index that tracks the performance of large and mid-cap companies across 23 developed markets. It provides a broad representation of the global developed equity markets.

Question 2: How is the index calculated?

The index is calculated by multiplying the market capitalization of each constituent company by its free-float adjusted shares outstanding. The resulting values are then summed and divided by a divisor that ensures the index remains constant over time.

Question 3: What are the key features of the index?

The MSCI World Index is characterized by diversification across countries, industries, and market capitalizations. Its long-term performance has been positive, with a notable recovery from market downturns.

Question 4: How can investors use the index?

Investors can use the MSCI World Index as a benchmark for their portfolios, compare the performance of different regions, and make informed investment decisions.

Question 5: What factors can affect the index's performance?

The index's performance can be influenced by global economic conditions, political events, interest rate changes, and currency fluctuations.

Question 6: Are there any limitations to the index?

While the MSCI World Index provides a comprehensive overview of the developed equity markets, it does not represent the performance of emerging markets or smaller companies.

This guide provides a comprehensive overview of the MSCI World Index, its methodology, and its significance for investors seeking exposure to the global equity markets.

See the next section for detailed insights on the index's composition and historical performance.

Tips for Global Investing with the MSCI World Index

The MSCI World Index MSCI World Index: A Comprehensive Guide To Global Equity Market Performance is widely followed to monitor the performance of developed market equities. To leverage this benchmark effectively, consider the following tips:

Tip 1: Use MSCI World ETFs or Funds

Invest in exchange-traded funds (ETFs) or mutual funds that track the MSCI World Index to access global equity exposure with diversification and low costs.

Tip 2: Track Global Market Trends

Monitor global economic indicators, interest rates, and geopolitical events that may impact the MSCI World Index's performance.

Tip 3: Consider Currency Hedging

If investing in non-local currency markets, consider currency hedging strategies to mitigate foreign exchange fluctuations.

Tip 4: Be Aware of Sector Biases

The MSCI World Index has a bias towards specific sectors like financials, technology, and healthcare. Consider complementing it with sector-specific investments to diversify.

Tip 5: Rebalance Regularly

Over time, the weights of different countries and sectors in the MSCI World Index may shift. Rebalance portfolios regularly to maintain the desired risk and return parameters.

By following these tips, investors can enhance their global equity investments using the MSCI World Index as a valuable tool.

MSCI World Index: A Comprehensive Guide To Global Equity Market Performance

The MSCI World Index is a stock market index that measures the performance of large and mid-cap stocks across 23 developed markets. It is a widely used benchmark for global equity market performance and provides valuable insights into the health and direction of the global economy. Here are six key aspects that investors should consider when using the MSCI World Index:

- Market Coverage: The index covers a broad range of developed markets, including the United States, Europe, and Asia, providing a comprehensive view of global equity performance.

- Market Capitalization: The index focuses on large and mid-cap stocks, which represent a significant portion of the global equity market and drive overall market trends.

- Country Weightings: The index is weighted by the market capitalization of each country's股票市场, with the United States holding the largest weighting, followed by Japan and the United Kingdom.

- Sector Representation: The index provides insights into the performance of different sectors, with a heavy weighting towards financials, technology, and consumer discretionary.

- Currency Impact: The index is denominated in US dollars, which means that currency fluctuations can impact its performance.

- Market Performance: The index tracks the overall performance of global equity markets, providing investors with a benchmark against which to measure their own investments.

By understanding these key aspects, investors can effectively utilize the MSCI World Index to gain insights into global equity market performance, make informed investment decisions, and track the progress of their portfolios in relation to a globally recognized benchmark.

India increases influence in emerging markets stocks | Northern Trust - Source ntam.northerntrust.com

MSCI World Index: A Comprehensive Guide To Global Equity Market Performance

The MSCI World Index is a stock market index that tracks the performance of large and mid-cap stocks in developed markets around the world. It is one of the most widely used benchmarks for global equity performance and is often used by investors to gauge the health of the global economy.

FTSE All-World vs. MSCI World: Welcher ETF ist besser? - Business Insider - Source www.businessinsider.de

The MSCI World Index is calculated by taking the weighted average of the market capitalizations of the stocks in the index. The index is weighted by market capitalization, which means that larger companies have a greater impact on the index than smaller companies. The index is composed of companies from 23 developed countries, including the United States, Japan, the United Kingdom, and Germany. The MSCI World Index is a free-float index, which means that it only includes shares that are readily available for trading.

The MSCI World Index is a valuable tool for investors who want to track the performance of global equity markets. The index provides a comprehensive overview of the performance of the world's largest and most liquid stocks and can be used to make investment decisions.