Celebrity News | Interesting updates about the latest celebrity news

Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues

Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues

Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues

{{Editor's Notes: "Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues" have published today date". Give a reason why this topic important to read. }}

{{Explain our effort doing some analysis, digging information, made Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues we put together this Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues guide to help target audience make the right decision. }}

{{Key differences or Key takeways, provide in informative table format }}

{{Transition to main article topics }}

Nikkei at 40,000? I Invesco | Invesco EMEA - Source www.invesco.com

FAQs: Nikkei 225 Surges Over 3%

Nikkei 225, the Japanese stock index, experienced a significant surge of over 3% due to a combination of the yen's depreciation and positive global cues. This positive market performance prompted interest in the underlying factors driving this surge.

Japan’s Lost Decades: 30 years of negative returns from the Nikkei 225 - Source investguiding.com

Question 1: What contributed to the Nikkei 225's strong performance?

The surge in Nikkei 225 is attributed to the weaker Japanese yen, making Japanese exports more competitive in the global market. Additionally, positive cues from global markets, such as the rise in U.S. stock indices and improving economic data, bolstered investor sentiment and contributed to the rally in Japanese stocks.

Question 2: How does a weaker yen impact Japanese stocks?

A weaker yen benefits Japanese exporters as it increases the value of their overseas earnings when converted back to yen. This makes Japanese products more attractive and competitive internationally, leading to increased exports and potentially higher profits for Japanese companies.

Question 3: What positive global cues influenced the Nikkei 225?

The rise in U.S. stock indices, particularly the Nasdaq Composite, indicated a positive outlook for the global technology sector. Additionally, improving economic data from major economies, such as the U.S. and China, signaled optimism about the global economic recovery, encouraging investors to take on more risk and invest in Japanese stocks.

Question 4: What are the potential implications of this surge for the Japanese economy?

The strong performance of the Nikkei 225 is expected to boost confidence in the Japanese economy and encourage further investment in the country. It could also lead to increased employment and economic growth as companies benefit from higher exports and profits.

Question 5: Is the surge in Nikkei 225 sustainable?

The sustainability of the Nikkei 225's surge depends on various factors, including the trajectory of the yen, the global economic outlook, and corporate earnings. While a weaker yen and positive global cues have supported the current rally, a reversal in these conditions could lead to a correction in the Nikkei 225.

Question 6: What should investors consider when investing in the Nikkei 225?

Investors should carefully assess their risk tolerance and investment horizon when considering investing in the Nikkei 225. The index is subject to market volatility and could experience fluctuations in value. It is important to diversify investments and consider investing in a broad range of assets.

In conclusion, the Nikkei 225's surge is attributed to a weaker yen and positive global cues. Investors should consider the potential implications for the Japanese economy and their own investment strategies when evaluating the Nikkei 225's performance.

Tips

The Nikkei 225 surged over 3% on Friday, boosted by a weaker yen and positive global cues. The index closed at 27,441.59, up 3.27% from the previous trading day. The surge was broad-based, with all sectors contributing to the gains. Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues

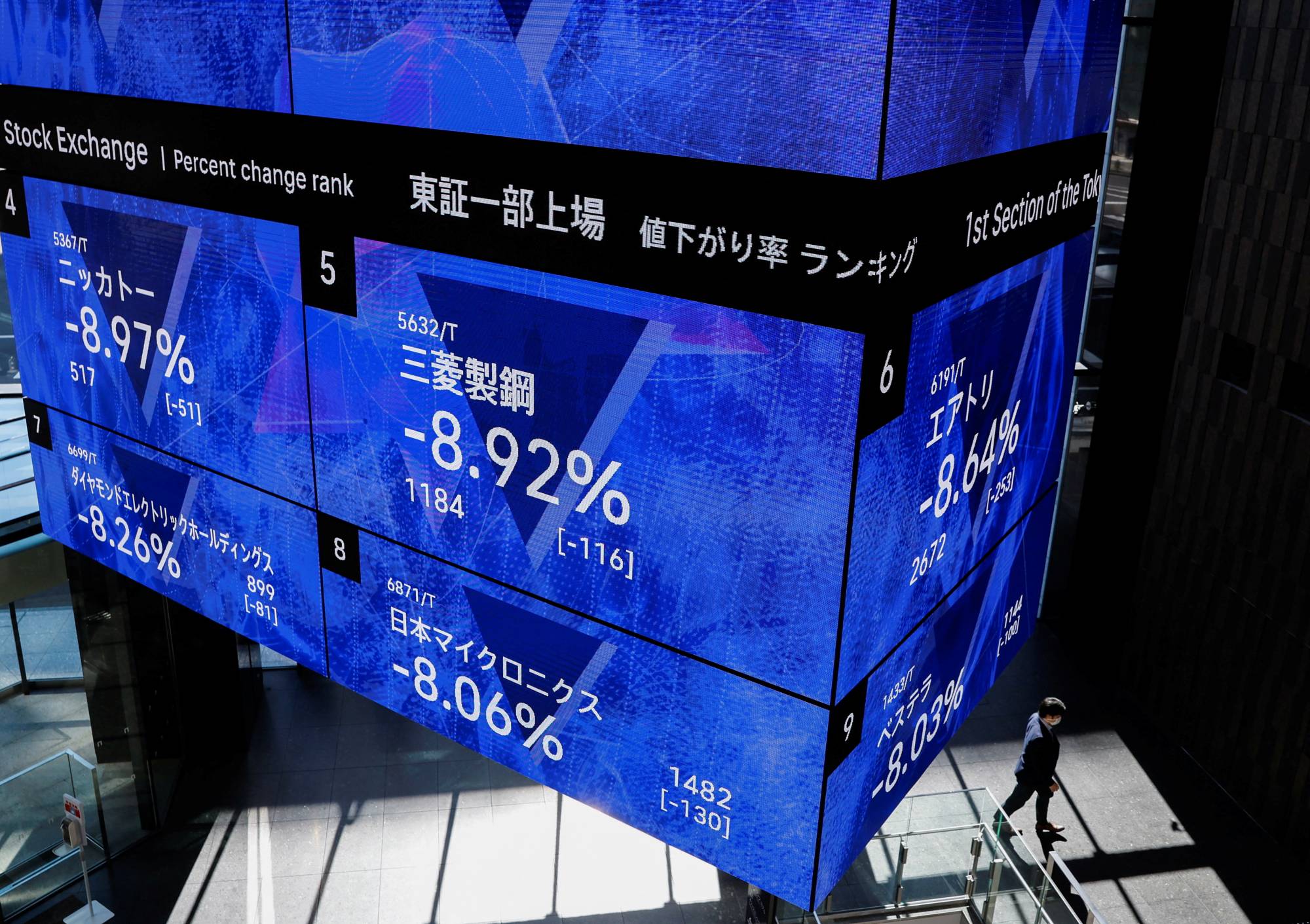

Stock Market Plunge Sparks Recession Fears - Newsweek - Source www.newsweek.com

Tip 1: The weaker yen provided a boost to the Nikkei 225. A weaker yen makes Japanese exports more competitive in global markets, which can lead to increased demand for Japanese goods and services. This, in turn, can boost the profits of Japanese companies and support the stock market.

Tip 2: Positive global cues also contributed to the Nikkei 225's gains. Global stock markets were broadly higher on Friday, buoyed by positive economic data and earnings reports. This positive sentiment spilled over into the Japanese market, helping to lift the Nikkei 225.

Tip 3: The Nikkei 225's surge was broad-based, with all sectors contributing to the gains. This suggests that the rally was driven by a combination of factors, rather than being concentrated in a single sector.

Tip 4: The Nikkei 225's surge is a positive sign for the Japanese economy. A strong stock market can boost consumer and business confidence, which can lead to increased spending and investment. This, in turn, can help to drive economic growth.

Tip 5: Investors should continue to monitor the Nikkei 225 and other global stock markets closely. The market outlook remains uncertain, and there are a number of risks that could derail the current rally. However, the Nikkei 225's surge on Friday is a reminder that there are still opportunities for investors in the Japanese stock market.

Summary of key takeaways or benefits:

- The weaker yen provided a boost to the Nikkei 225.

- Positive global cues also contributed to the Nikkei 225's gains.

- The Nikkei 225's surge was broad-based, with all sectors contributing to the gains.

- The Nikkei 225's surge is a positive sign for the Japanese economy.

- Investors should continue to monitor the Nikkei 225 and other global stock markets closely.

Transition to the article's conclusion:

The Nikkei 225's surge on Friday was a welcome sign for investors in the Japanese stock market. The rally was driven by a combination of factors, and it suggests that there are still opportunities for investors in the market. However, investors should continue to monitor the market closely, as there are a number of risks that could derail the current rally.

Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues

The Nikkei 225, Japan's benchmark stock index, jumped over 3% on Tuesday, buoyed by a weaker yen and positive global market sentiment.

- Weaker Yen: The yen's weakness against the US dollar made Japanese exports more competitive, boosting the outlook for corporate earnings.

- Positive Global Cues: Strong performance in global stock markets, particularly in the US and Europe, provided a positive backdrop for the Nikkei.

- Economic Recovery: Optimism over the global economic recovery, supported by vaccine rollouts and stimulus measures, boosted investor sentiment.

- Sectoral Gains: Gains were broad-based, with sectors such as autos, technology, and consumer goods leading the surge.

- Increased Liquidity: The Bank of Japan's continued monetary easing has provided ample liquidity in the Japanese market, supporting stock prices.

- Foreign Buying: Foreign investors have been net buyers of Japanese stocks, attracted by the relatively low valuations and the weaker yen.

Japan's Nikkei 225 Surges to 33-Year Peak, With an 18% YTD Gain - Tokenist - Source tokenist.com

The Nikkei's surge highlights the interconnectedness of global markets and the importance of factors such as currency valuations, economic outlook, and investor sentiment in driving stock market movements.

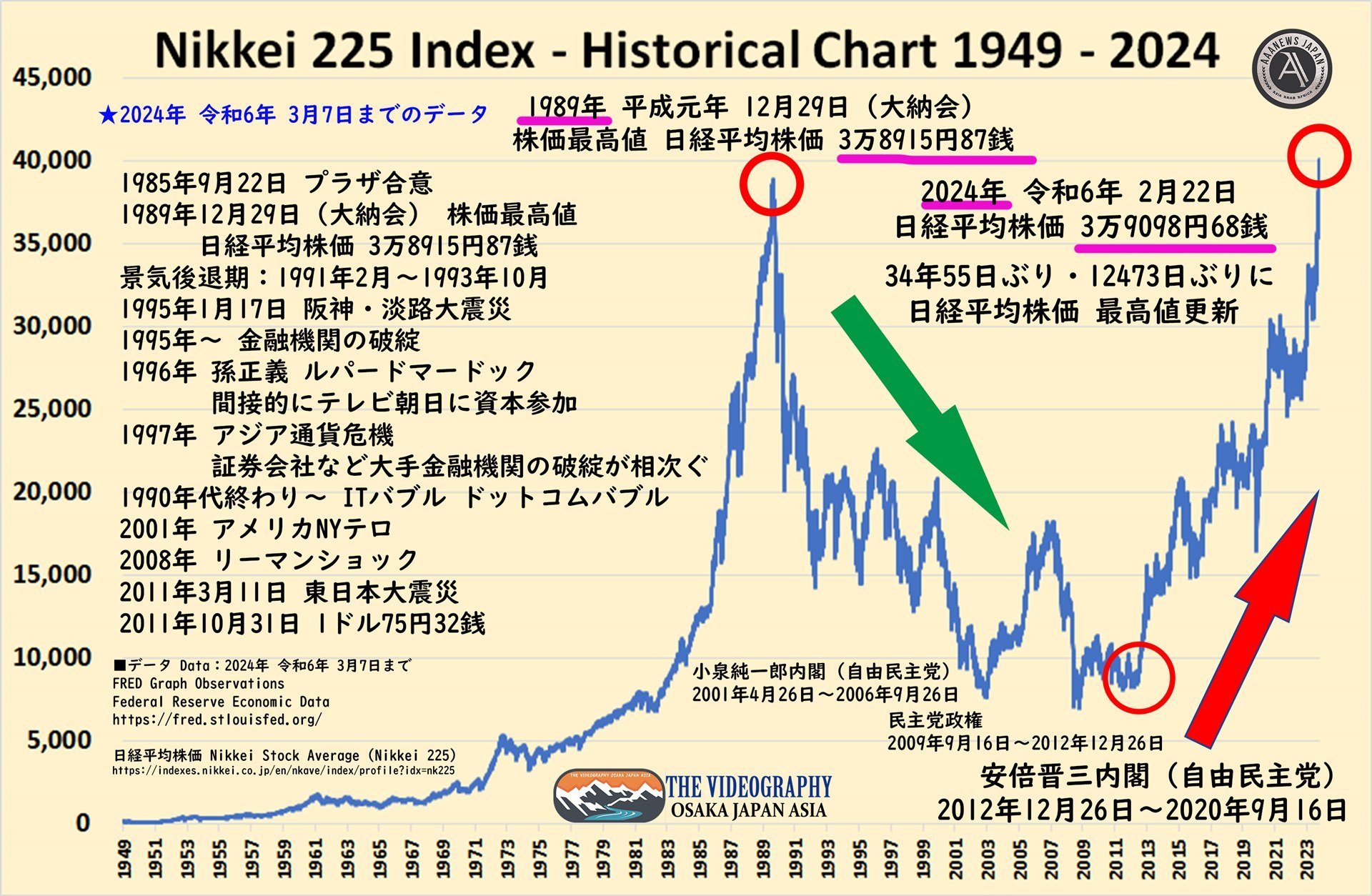

Nikkei 225 Index Historical Chart 1949 - 2024・日経平均株価 - Source videographyosaka.com

Nikkei 225 Surges Over 3% On Weaker Yen, Positive Global Cues

The Nikkei 225 index surged over 3% on Tuesday, as the yen weakened against the US dollar and positive global cues boosted sentiment. The Japanese yen fell to a six-week low against the US dollar, making Japanese exports more competitive. This, in turn, lifted the Nikkei 225 index, which is heavily weighted towards export-oriented companies.

Weaker Yen Boosts Nikkei As Investors Eye Fed Rate Decisions - Source www.businesstoday.com.my

In addition to the weaker yen, positive global cues also contributed to the Nikkei 225's rise. Wall Street stocks closed higher on Monday, with the Dow Jones Industrial Average gaining over 1%. This positive sentiment spread to Asian markets, with the Nikkei 225 following suit. The index is now up over 10% for the year, as investors bet on a continued recovery in the Japanese economy.

The rise in the Nikkei 225 is good news for the Japanese economy. A stronger stock market can help to boost consumer confidence and encourage businesses to invest. This, in turn, can lead to economic growth. The Nikkei 225's rise is also a sign of confidence in the Japanese government's economic policies.

However, there are some risks to the Nikkei 225's continued rise. The yen could strengthen against the US dollar, which would hurt Japanese exports. In addition, the global economy could slow down, which would reduce demand for Japanese goods.

Despite these risks, the Nikkei 225's rise is a positive sign for the Japanese economy. The index is now at its highest level since 1991, and it is likely to continue to rise in the coming months.

Conclusion

The Nikkei 225's rise is a positive sign for the Japanese economy. The index is heavily weighted towards export-oriented companies, so a weaker yen and positive global cues have helped to boost the index. The Nikkei 225's rise is also a sign of confidence in the Japanese government's economic policies.

However, there are some risks to the Nikkei 225's continued rise. The yen could strengthen against the US dollar, which would hurt Japanese exports. In addition, the global economy could slow down, which would reduce demand for Japanese goods.

Despite these risks, the Nikkei 225's rise is a positive sign for the Japanese economy. The index is now at its highest level since 1991, and it is likely to continue to rise in the coming months.